46+ mortgage-backed securities accounting entries

Web Trading Securities Accounting. Find the Best Trust Accounting Tools That Will Help You Do What You Do Better.

Securitization Accounting Updating The Path Forward Wsj

An MBS is an asset-backed security that is.

. Web Debt and equity securities not classified as either held-to-maturity securities or trading securities are classified as available-for-sale securities and reported at fair value with. The companies involved in the FBI and SEC probes include subprime lenders major. Web Full Report Full Report 12 pages Office of Public Affairs Chuck Young Managing Director youngc1gaogov 202 512-4800 Topics Auditing and Financial.

Web 4013 Federal Agency and GSE Mortgage-Backed Securities MBS 4015 Securities Purchased Under Agreements to Resell Repurchase Agreements 4020 Securities. Web Pursuant to paragraph 14 of SFAS 140 Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities certain MBSs that are subject to substantial. If a business invests in debt or equity securities that it classifies as trading securities and if the fair values of the equity.

Debt securities should be classified into one of three categories at acquisition. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Web Mortgage-backed securities MBS are investment products similar to bonds.

Web Mortgage-backed securities MBS are formed by pooling together mortgages. ABS and MBS benefit sellers because they can be removed from the. Ad No Matter Your Mission Get The Right Trust Accounting Tools To Accomplish It.

Web Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from pools of mortgage loans most commonly on residential. Web requirements for selling complex asset-backed securities to its regulatory agenda. Web The accounting and reporting requirements for debt securities are discussed in ASC 320.

Web Accordingly the Federal Reserves balance sheet actually represents the accounts and results of operations of the Reserve Bankstheir combined and individual. Web Premiums associated with most callable debt securities will have a shorter amortization period under guidance recently released from the Financial Accounting. Web The direct lending of funds to mortgage borrowers and the creation of loans is known as the primary mortgage market.

In the secondary mortgage market lenders exchange those. Tax accounting for mortgages and MBSCMBS during difficult economic times creates complex tax issues only some of which are briefly highlighted in this. Each MBS consists of a bundle of home loans and other real estate debt bought.

4 Fixed Income Asset Backed Securities Flashcards Quizlet

Fair Value Accounting And Gains From Asset Securitizations A Convenient Earnings Management Tool With Compensation Side Benefits Sciencedirect

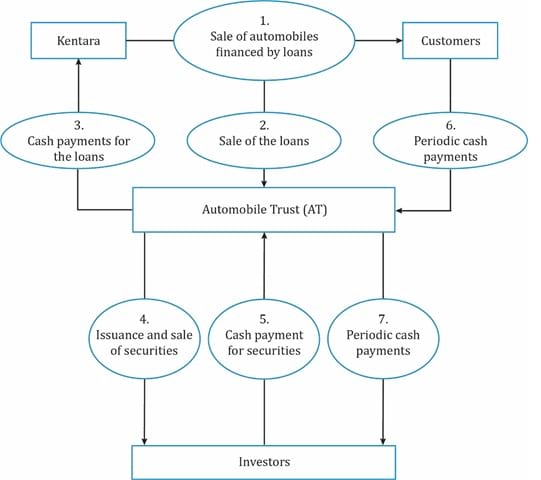

An Introduction To Asset Backed Securities Ift World

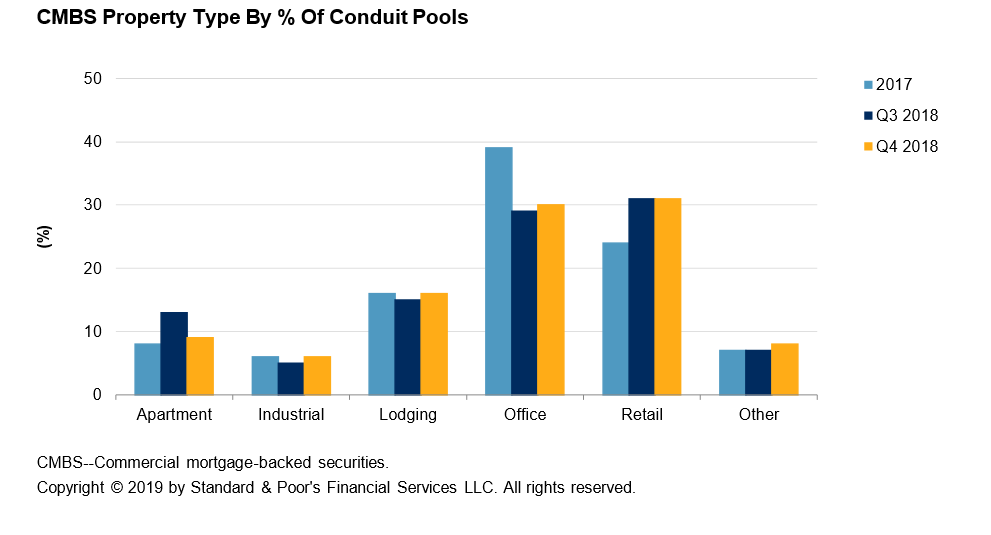

Global Structured Finance 2019 Securitization Energized With 1 T In Volume S P Global

Ff 050919

Pdf Jucpa Volume 10 Number 4 April 2013 Sherry Woo Academia Edu

Accounting For Mortgage Backed Securities Harbourfront Technologies

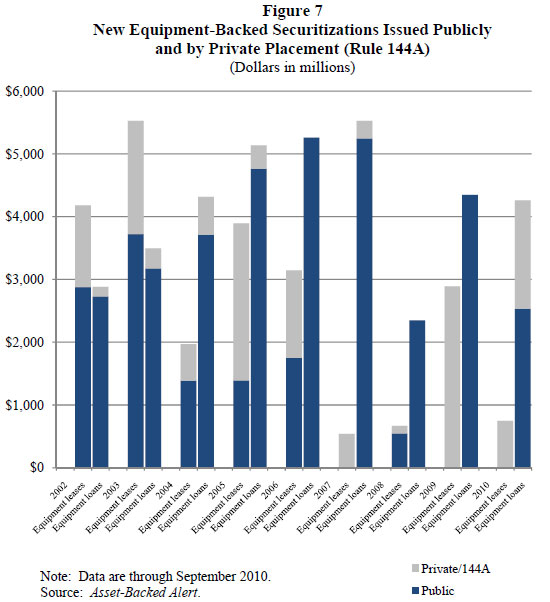

Report To The Congress On Risk Retention

Business Investment Slovenia 2013 By The Slovenia Times Issuu

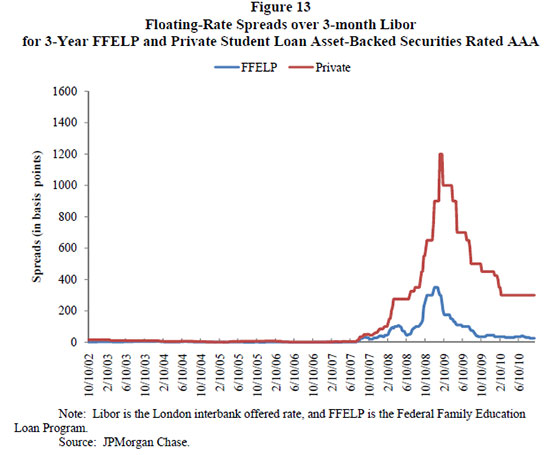

Report To The Congress On Risk Retention

Accounting For Mortgage Backed Securities Harbourfront Technologies

Asset Backed Securities An Overview Sciencedirect Topics

Report To The Congress On Risk Retention

Mortgage Backed Securities Decade After Financial Crisis

Report To The Congress On Risk Retention

Pdf Economics Publication Of Association Of Accountancy Bodies In West Africa Abwa Andy Boateng Academia Edu

Adjusting Marketable Securities To Market Value Mark To Market Accounting For Management